Calculadoras Calculator blog Mensajes sobre el tema: HP Prime finance app

Calculator blog

Musings and comments about our common interest

The HP Prime Finance app

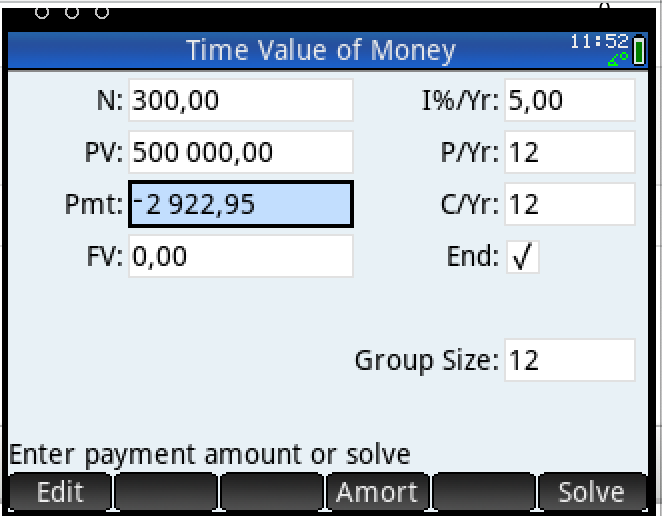

Initially, the HP Prime finance app only had the TVM solver. It was a good solver since it included everything, from number of payments per year. Good to calculate mortgage payments, but with the right knowledge, useful for many other financial calculations. Here is a screenshot of how it looked like (and continues looking since this part has not changed)

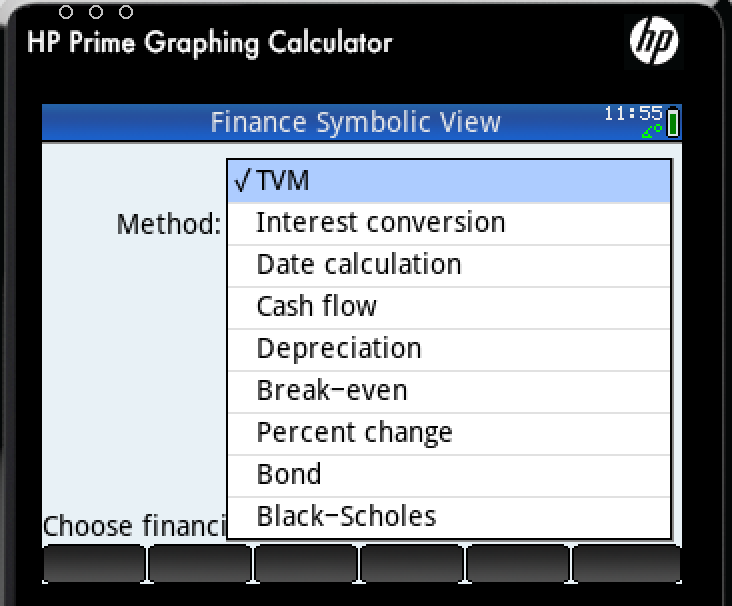

But now there are many more options that turn your prime into a complete financial calculator. To get them, you need to update your firmware to the last onem through your HP connectivity kit application.(choose the one for your operating system and then have it upgraded to the latest version by running the "look for upgrades" option in the help menu. Then connect your calculator and update it. Do not disconnect your calculator during the process)

(By the way: you can test all these features at no cost by downloading the HP Prime app in hpcalc.org, with all alternatives for different operating systems)

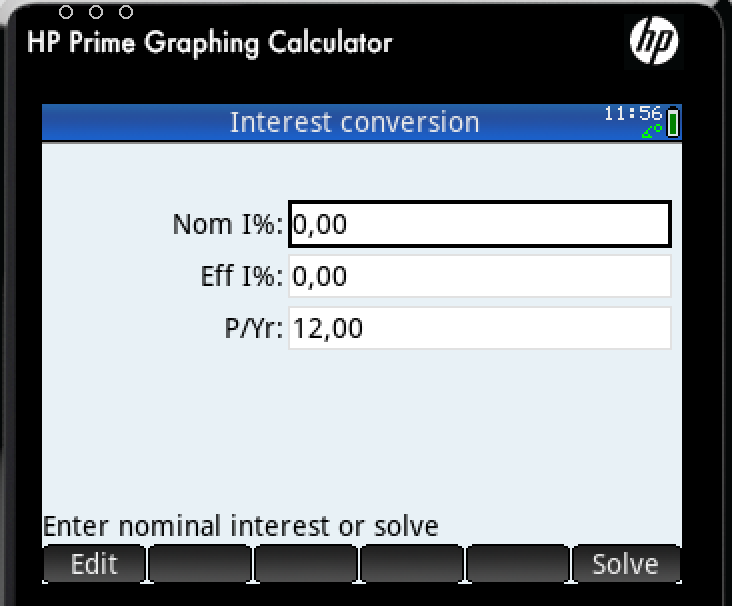

Let's take a look at the first menu: interest conversion with different composition periods:

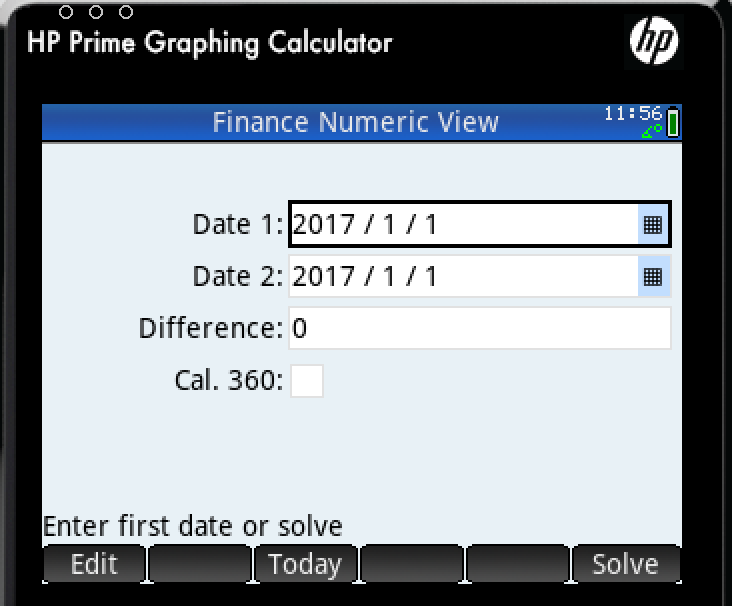

The following one is more interesting when calculating investments: the date calculation app: serves to find which date is, for example, 90 days from now. It has also a provision for 360 days per year calculations, as it is common in the banking industry to calculate interest over 360 and not 365,25 days.

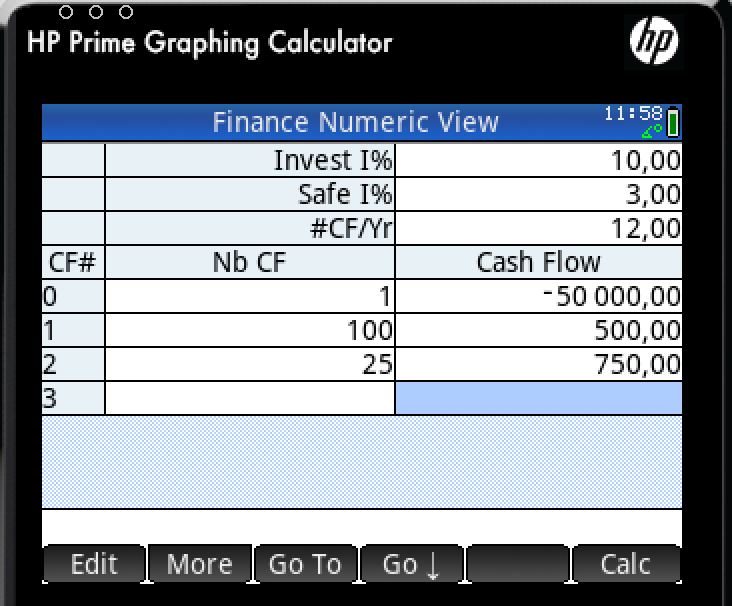

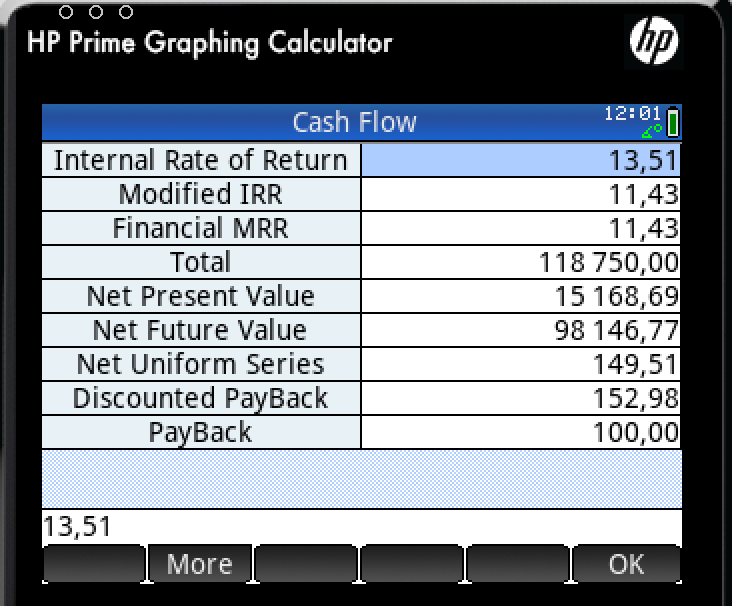

The following one is the cashflow app. It has two main screens: the data entry and the results. It allows both risk-free interest rate and investment interest rate, and calculates all the typical figures off an investment.

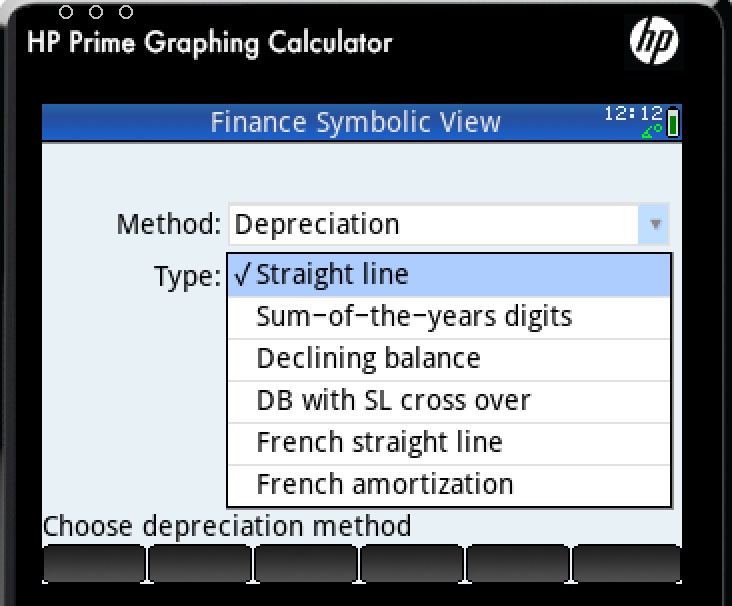

Then there is the depreciation portion of the app. Depreciation is one of the most boring parts of finance for me (as a finance manager). Well, here we have the complete palette of possibilities:

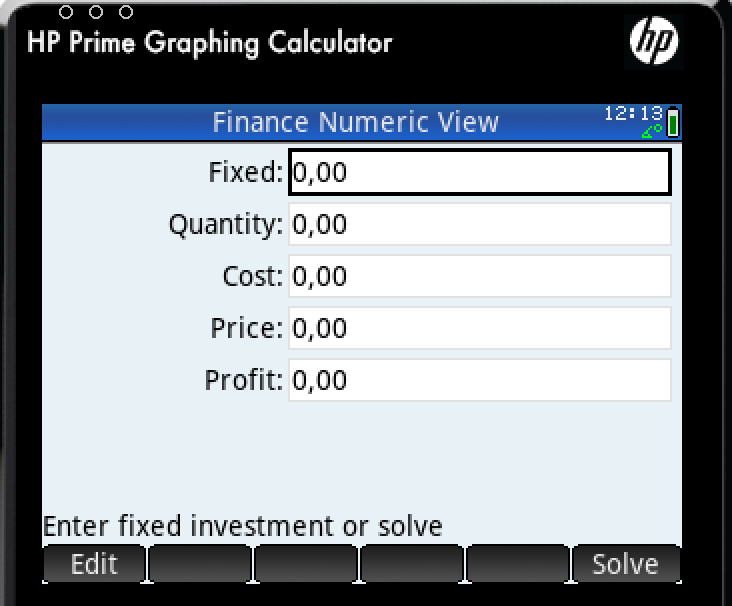

Now, you have a short app for break even analysis. (all of these calculations - and this is valid for the rest of the apps - are usually done in Excel or similar; but these are extremely useful when you are in a board room or checking someone else's hypothesis)

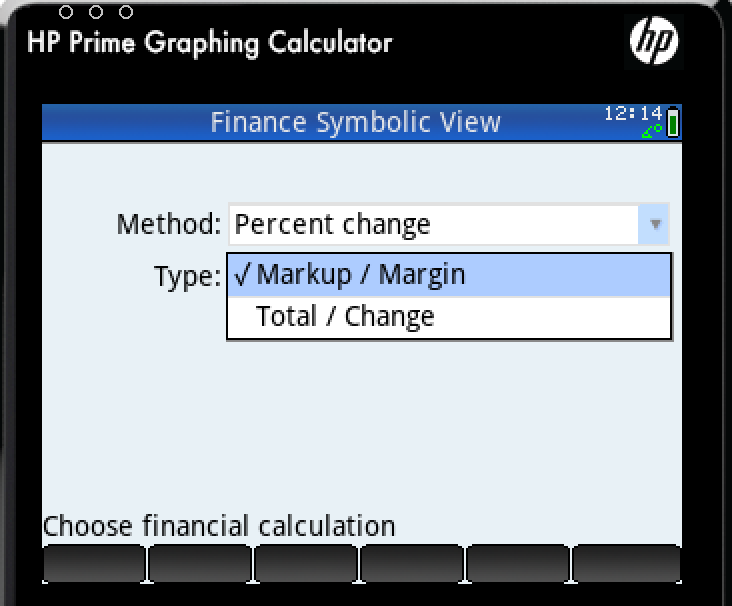

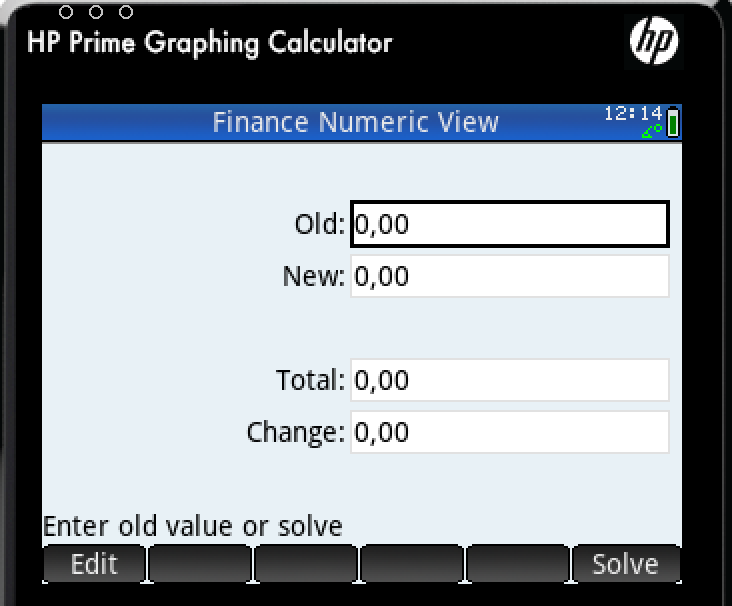

Then we have the percent calculations. It is surprising how many people do not understand how percentages work. ("I raise the price a 20% and then I offer a 20% discount" type of weird logic). These two pages help us. When analyzing financial statements, the one with % change and % of total is a must for quick calculations. Both numbers are calculated each time, making comparisons faster)

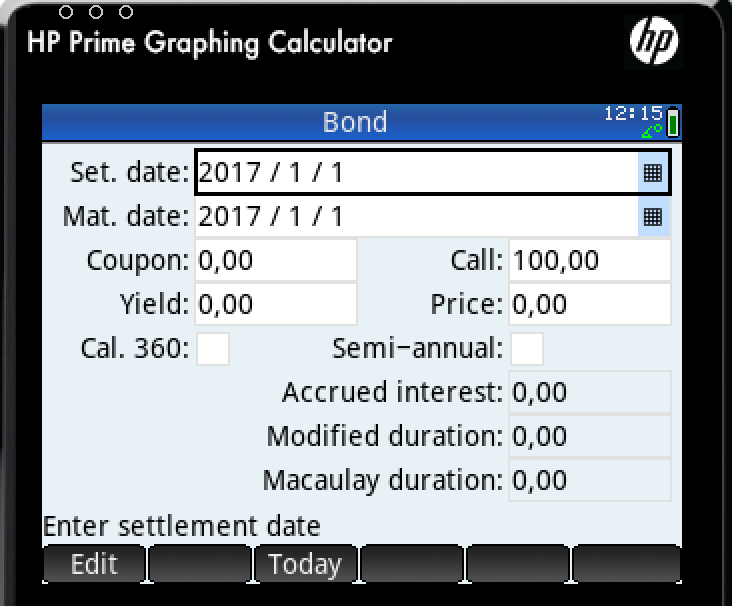

There are two more left. One is bonds (as I am in a production company, this is something I have never used - but if you are in an investment bank or fund, this is something you want to have in your calculator)

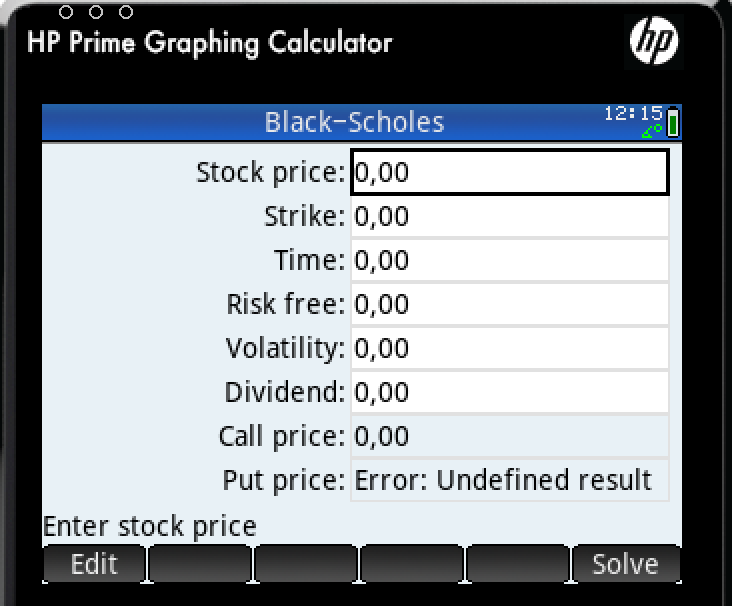

And the other is the Black and Scholes formula for valuation of financial products at risk: